Trump’s Tariffs and Duties and the Transformation of World Economy

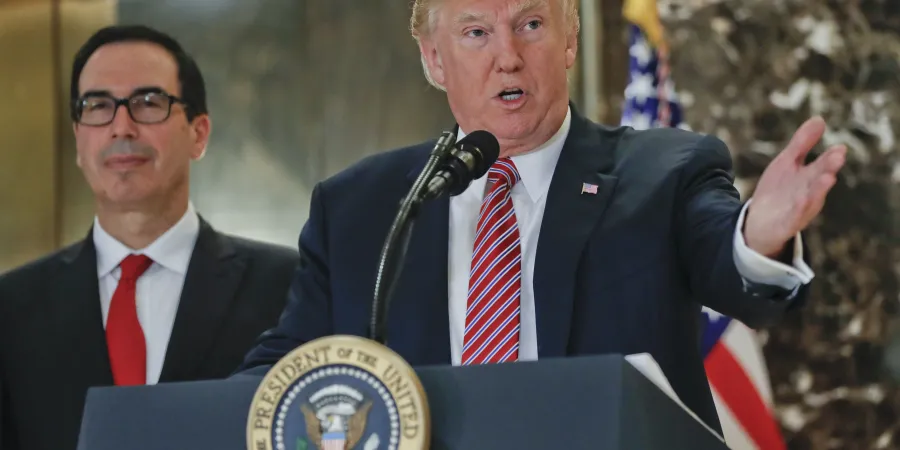

“We need to consider trade policy together with strategy: if US protectionism increases, the growth of peripheral economies will decrease.” Prof. Giancarlo Elia Valori discusses the economic repercussions of President Trump’s current and future moves in his pursuit to “make America great again”

Giancarlo Elia Valori

| 14/05/2018

The 45th President of the United States, Donald J. Trump, keeps on repeating he wants to make America "great again.”

Hence, first and foremost, he wants to reindustrialize his country which, in fact, is currently the world champion in the loss of productive, manufacturing or industrial companies.

The birth of a country that now consumes without producing much, namely the USA, materialized initially under Reagan’s Presidency but continued rapidly with the successive Presidents.

For example, at the end of the 1960s, the US industrial labor force was at least 35% of the total number of people employed, while currently, this labor force is only 20%.

Since 2001, over 70,500 companies with more than 500 employees have been closed down definitively.

The Gospel of Matthew (4:1-11) perfectly clarifies the situation of the post-productive post-economy – if we can use this expression.

Jesus Christ, who was hungry after having fasted forty days and forty nights in the desert, was tempted by the devil who told him: “If you are the Son of God, command these stones to become loaves of bread.”

Jesus answered to the devil: “Man shall not live by bread only, but by every word that comes from the mouth of God.”

Hence, Jesus – as a great economist – explains to the devil that we must not change the Creation and replace God, but instead follow Smith’s liberal and socialist labor theory of value.

Without the processing and transformation of materials – according to their laws – there is no value and therefore not even price.

Only manual (or intellectual) work, in fact, does transform materials, but never creates and hence does not even destroy them.

Hence, we should produce only those goods and services that the market really asks for, without useless miracles, which are already incorporated in the Being as it is.

But let us revert to the economy of the powerful and stable North American de-industrialization process.

However, some sectors of US companies are still active, such as semiconductors and electronics, while clothing, for example, has fallen by 60% despite the US population has almost doubled since 1950.

When this happens, high value-added work increases, while all productive activities having a low incidence of unit value have definitively been delocalized outside the USA (and the EU – although in this case, the debate has a political, military, and strategic nature).

It is worth recalling that immediately before the first subprime crisis of 2016, the US industrial production had fallen by 15% – and this was certainly not by mere coincidence.

Later it started to grow again by approximately 4% – with many sectoral differences – in the years in which the United States managed to move its financial crisis elsewhere.

But let us revert to the factories that the US President deems necessary to make America great again, and to the specific policy of import and export duties imposed by President Trump in record time.

In fact, on March 1, 2018, the President announced he would impose a 25% customs duty on steel imports from China and a 10% additional one on aluminum imports from China.

This, however, increases the production costs of the aforementioned US sectors that still handle and stand up to global competition, which obviously recoup the money lost from end customers, by increasing prices.

If – like the USA, but perhaps not for much longer – a country still lives on electronic manufacturing and components, the increase in the factory unit prices leads to an increase in the final price and, hence, restricts domestic or foreign markets.

Any price increase, albeit small, leads to a decrease in the buyers of those goods. Pareto taught this to us ad nauseam.

But clearly, it was not enough.

Later, on April 3, President Trump announced he would impose further 25% duties on additional 50 billion Chinese imports of electronics and aerospace products, as well as machine tools.

This means that – paradoxically, but not too much so – President Trump wants to slow down precisely the productive sectors that China deems strategic for the future, as shown in its Plan for 2025.

In 2017, China produced a total of 23.12 trillion US dollars, calculated on the basis of power purchasing parity (PPP).

Currently, the EU ranks second, with 19.9 trillion US dollars, again calculated as PPP. In 2016, it was the world's top producer.

The United States only ranks third, with a yearly product of only 19.3 trillion dollars.

Financial stones cannot be turned into loaves of bread.

In spite of everything, China has a yearly per capita income of USD 16,600, while the US yearly GDP per capita is equal to 59,500 US dollars.

Scarce domestic consumption, all focused on exports, is the Chinese model that has developed since Deng Xiaoping’s “Four Modernizations,” which survives only in an area in which all macroeconomic variables are not left to some “market” invisible hands, but to a central authority.

However, this is exactly the reason why China is the largest world exporter.

Hence it rules end markets.

In 2017, it shipped abroad USD2.2 trillion worth of goods and services.

Currently, 18% of Chinese products are exported to the United States.

This much contributes to the US trade deficit, which currently amounts to USD375 billion.

China is also the second largest importer in the world, to the tune of USD1.7 trillion in 2017.

The mechanisms of interaction between China and the United States, however, are even more complex than we could guess from these scarce data and statistics.

It is not by mere coincidence that China is still the largest holder of US public debt.

In January 2018, China held 1.2 trillion in US government debt securities, i.e., 19% of the US public debt held by foreign investors.

A very powerful monetary, political, strategic, and even military leverage.

Obviously, China buys US securities to back the value of the dollar, to which the yuan is pegged.

However, it devalues its currency (and hence the US dollar) when Chinese prices need to be kept competitive.

Therefore, while the United States wants to increase the yuan value, with a view to favoring its exports, China threatens to sell its US public debt securities immediately.

The dollar increased by 25% between 2014 and 2016, but since 2005 China has devalued the yuan.

A very clear example of aggressive monetary pegging.

Moreover, the issue of China's unfair commercial behavior is now long-standing and it was also raised by many candidates to the US presidential elections.

In fact, the success of Paulson, the former US Treasury Secretary, was to reduce the American trade deficit with China and to later ask for opening to foreign investment in key sectors of the Chinese economy.

For example, in the banking sector, thus putting an end – in some cases – to the Chinese practice of export subsidies and administered and capped prices.

Just deal with realism and intelligence, and Chinese Confucianism can find solutions to everything.

The other side of the Chinese miracle, however, is the very high debt of companies and households, which is obviously still connected to the balance between the yuan and the US dollar.

In this case, however, the programmed slowdown of the Chinese GDP growth and the limits on strong currency exports, as well as the control of wages and profits are enough.

But let us revert to President Trump's tariffs and duties.

The US President has imposed these new tariffs and duties on Chinese imports to force China to remove the foreign investors’ obligation to transfer technology and patents to their Chinese partners.

Nevertheless, China trades many products it could also manufacture on its own just because it wants to fully open Western intellectual property rights for its companies.

A few hours later, however, China responded to President Trump with a 25% increase in duties on 50 billion dollars of US exports to China.

On April 6, President Trump further reacted by stating he would call for the imposition of other duties on additional 100 billion dollars of imports from China.

It is worth noting, however, that this accounts for only a third of total US imports from China, which is considering the possibility of responding harshly to President Trump by steadily increasing tariffs and duties for all US products entering Chinese markets.

Besides the issue of relations with China, the other side of the US tariff and duty issue is the NAFTA renegotiation, officially requested by President Trump on August 16, 2017.

It should be recalled that the North American Free Trade Agreement is the largest commercial agreement currently operating in the world, signed by Canada, Mexico, and the United States.

Firstly, President Trump wants Mexico to cut – almost entirely – VAT on imports from the USA and put an end to the program of maquiladoras, i.e., the factories owned by foreign investors in Mexico, in which the components temporarily imported into that country under a duty-free scheme are assembled or processed.

The maquiladoras program started in 1965 to reduce the huge unemployment in the North Mexican regions, but currently, there are at least 2,900 such factories between Mexico and the USA producing 55% of total Mexican export goods.

They mainly manufacture cars and consumer electronics, which are exactly the sectors that – as already seen – President Trump wants to revitalize.

Obviously, the current US Presidency wants to dismantle the maquiladoras on its Mexican border, where 90% of such companies are located.

Thanks to these special factories, Mexico competes directly with US workers, considering that the local Central American workforce is much cheaper.

Thanks to this mechanism of cross-border production outsourcing – between 1994 and 2010 alone – 682,900 US jobs moved to Mexico, with 80% of US jobs lost in the manufacturing sector.

Moreover, again due to NAFTA, as many as 1.3 million jobs in Mexican agriculture were lost.

In fact, following the removal of duties between the USA and Mexico, the latter was flooded with US produce below cost and subsidized by the State.

All this happened while the Central American administration cut agricultural subsidies – which will soon happen in the crazy EU as well – and focused the little State aid left for agriculture to the big haciendas, thus destroying and ruining small farmers.

Liberal and free-trade masochism.

NAFTA, however, also has many advantages for the United States.

Without the tripartite inter-American agreement, North American food prices would be significantly higher, while also oil and gas from Mexico and Canada would be much more expensive for US consumers.

As Carl Schmitt taught us, the American Monroe Doctrine (epitomized by the slogan “America to the Americans”) was developed above all against Europe. Nevertheless, the agreements like NAFTA allow sharing – at least partially – the benefits of increased trade between the USA, Canada, and Mexico in a less asymmetric way than usual.

The US primacy theorized by Monroe in 1823 and later rearticulated by Roosevelt in his State of the Union address in 1904, with the Roosevelt Corollary whereby “chronic wrongdoing may in America, as elsewhere, ultimately require intervention by some civilized nation and force the United States, although reluctantly, in flagrant cases of such wrongdoing, to the exercise of an international police power,” holds true also at the economic level.

But are we currently sure that the most civilized nation is still the Northern one?

Just to better understand what we are talking about, it should be noted that the NAFTA agreement is made up of 2,000 pages, with eight sections and 22 chapters.

As such, it is currently worth 0.5% of the US GDP.

Since the official implementation of this agreement in the three countries which have adopted it, North American exports have created as many as 5 million jobs, with the creation of 800,000 additional jobs in the USA alone.

Nevertheless, approximately 750,000 other jobs have also been lost in the United States alone, mainly due to the transfer of US activities to Mexican maquiladoras.

A slight surplus.

Moreover, NAFTA has anyway ensured the status of "most favored nation" to Canada and Mexico and has removed all tariffs and duties for the goods produced in one of the three Member States. It has finally established certain and clear procedures for settling trade disputes between the companies of every country belonging to it.

But above all, NAFTA enables the United States to better compete with EU and Chinese products, by reducing the prices of the NAFTA goods wherever they are produced.

Also in this case, however, President Trump has threatened to walk out of the inter-American trade treaty and impose a 35% duty on imported Mexican products.

The aim is obviously to bring back investment in the maquiladoras to the United States.

Is this useful, also with regard to an evident trade war with the EU, Japan, and China, as usual?

Is there currently sufficient real liquidity in the United States to back the supply increase which is thus created, with the return of all these productions back home?

Or is the idea prevailing of having everything be bought on credit, with all the consequences we can easily imagine?

Or is it possibly a matter of sending the NAFTA productive surplus back to European, Chinese and Asian markets?

Moreover, with specific reference to another multilateral trade agreement, the Trans-Pacific Partnership (TPP), President Trump announced he would like to establish a series of new bilateral trade relations that the US President likes more than the multilateral ones.

It is worth recalling that the TPP applies to the USA and to other 11 countries around the Pacific Ocean, namely Australia, Brunei, Canada, Chile, Malaysia, Japan, Mexico, New Zealand, Peru, Singapore and finally Vietnam.

All these countries together account for 40% of the total global GDP, which is currently equal to USD107.45 trillion annually. They are also worth over 26% of world trade per year and as many as 793 million global consumers.

Obviously, the list does not include China and India, considering that the TPP architecture has been designed to surround, close or at least limit the growth of the two great Asian countries.

President Trump also wants to renegotiate the TPP, which by 2025 is expected to increase trade among all Members States to the tune of 305 billion us dollars per year.

Hence, if President Trump walks out of the TPP, many Member States will look to China for replacing the USA – and, indeed, many of them are already doing so.

Therefore, the US President’s idea is to make the United States grow – through this wave of various forms of protectionism – by at least 6% a year, with an expected 3% net tax increase.

Too much. It would inevitably lead to high inflation and the classic boom-bust cycle.

If the economy grows by 2-3% a year, the cycle can expand almost indefinitely.

Conversely, if there is too much money looking for too few goods to buy, inflation will always come, and the booming phase will stop all of a sudden.

Hence, the bust materializes, with the quick reduction of wages and credits, as well as with an increase in prices and interest rates.

Therefore, President Trump’s very dangerous idea is that – in such a monetary and economic context – the United States can keep on borrowing all the liquidity needed because, as he said recently, “we never default, because we can print our currency.”

This is true. But if too many green bucks are printed, interest rates will rise immediately, and this new version of Reagan-style supply-side economics will be stopped.

Finally, a very serious recession would materialize, which currently would not be so easy to export to “friendly” countries.

Recently, the dollar area has much shrunk.

It is no longer true – as the former US Treasury Secretary John Connally once told to his European colleagues – that “the dollar is our currency, but it is your problem.”

So far, however, President Trump has decided 29 commercial or financial deregulation operations and over 100 internal guidelines and directives to the Administration, as well as other 50 new global market rules discussed by the Congress.

On February 3, 2017, the US President also decided to reform and almost repeal the rationale of the Dodd-Frank Wall Street Reform Act, with rules and regulations further reducing checks and audits on banks, which are no longer obliged to send to the Treasury Ministry data and information about the loans granted.

Moreover, the banks with clients’ deposits lower than USD10 billion must not even abide by the Volcker Rule, which forbids banks to use clients deposits to make a profit.

Therefore, since 2015, banks cannot hold hedge funds and private equity funds.

Nowadays, however, with the reform of the Dodd-Frank Act, many credit institutions can avoid these difficulties and restrictions and play roulette with clients’ deposits.

For the new US lawmaker, Volcker’s and Greenspan’s policy was a way to avoid the implosion of the US financial system, after the fatal end of the Glass-Steagall Act which had been lasting since 1933.

It is worth recalling that the Glass-Steagall Act had come into force when the Roosevelt’s Presidency decided to imitate the Fascist legislation of the new separation between deposit banks and merchant or investment banks.

Banks did not want the Glass-Steagall Act because they wanted to be “internationally competitive.”

They also wanted to create money at will, regardless of the relationship between investment and collection.

What happened is before us to be seen.

President Trump wants to abolish even the Departments of Education and Environmental Protection, with an increase in military spending that is supposed to lead to a total public deficit of USD577 billion.

Hence, in this new context, can the US Presidency avoid the Chinese commercial pressure and also ensure that the jobs repatriated to the USA from NAFTA, from negotiations with Japan, from the TPP and the rest of the multipolar trade system are such as to back the dollar without creating excessive inflation?

Moreover, all international trade experts agree that it is not the simple and traditional tariff barriers – but rather the non-tariff ones, which are very fashionable today – to cause real problems.

In short, we need to consider trade policy together with strategy: if US protectionism increases, the growth of peripheral economies will decrease.

Thus, there will be increasing possibilities of crises in developing countries, while China's desire to replace the USA in multilateral economic mechanisms that directly affect it may increase enormously.

Also the desire of global US competitors, such as the EU, to replace US exports at unchanged rates – at least for a short lapse of time – may increase.

There is no need for dumping – non-tariff transactions and the quality standard of made-in-Europe products are enough.

Therefore, nowadays, nothing is certain.

Certainly not US protectionism, of which we have noted the dangers for North America and also for its geo-economic partners. Not even universal free trade, which does not consider the political evaluations and the economic, monetary and military planning of the various world commercial areas, is feasible and practicable.

Indeed, as in military policy, a great agreement – as the initial GATT was – is required in the current world market, with a view to establishing – for at least ten years – the areas and spheres of economic and productive influence and their possible future changes.

There is no free trade without planning.

“We need to consider trade policy together with strategy: if US protectionism increases, the growth of peripheral economies will decrease.” Prof. Giancarlo Elia Valori discusses the economic repercussions of President Trump’s current and future moves in his pursuit to “make America great again”

The 45th President of the United States, Donald J. Trump, keeps on repeating he wants to make America "great again.”

Hence, first and foremost, he wants to reindustrialize his country which, in fact, is currently the world champion in the loss of productive, manufacturing or industrial companies.

The birth of a country that now consumes without producing much, namely the USA, materialized initially under Reagan’s Presidency but continued rapidly with the successive Presidents.

For example, at the end of the 1960s, the US industrial labor force was at least 35% of the total number of people employed, while currently, this labor force is only 20%.

Since 2001, over 70,500 companies with more than 500 employees have been closed down definitively.

The Gospel of Matthew (4:1-11) perfectly clarifies the situation of the post-productive post-economy – if we can use this expression.

Jesus Christ, who was hungry after having fasted forty days and forty nights in the desert, was tempted by the devil who told him: “If you are the Son of God, command these stones to become loaves of bread.”

Jesus answered to the devil: “Man shall not live by bread only, but by every word that comes from the mouth of God.”

Hence, Jesus – as a great economist – explains to the devil that we must not change the Creation and replace God, but instead follow Smith’s liberal and socialist labor theory of value.

Without the processing and transformation of materials – according to their laws – there is no value and therefore not even price.

Only manual (or intellectual) work, in fact, does transform materials, but never creates and hence does not even destroy them.

Hence, we should produce only those goods and services that the market really asks for, without useless miracles, which are already incorporated in the Being as it is.

But let us revert to the economy of the powerful and stable North American de-industrialization process.

However, some sectors of US companies are still active, such as semiconductors and electronics, while clothing, for example, has fallen by 60% despite the US population has almost doubled since 1950.

When this happens, high value-added work increases, while all productive activities having a low incidence of unit value have definitively been delocalized outside the USA (and the EU – although in this case, the debate has a political, military, and strategic nature).

It is worth recalling that immediately before the first subprime crisis of 2016, the US industrial production had fallen by 15% – and this was certainly not by mere coincidence.

Later it started to grow again by approximately 4% – with many sectoral differences – in the years in which the United States managed to move its financial crisis elsewhere.

But let us revert to the factories that the US President deems necessary to make America great again, and to the specific policy of import and export duties imposed by President Trump in record time.

In fact, on March 1, 2018, the President announced he would impose a 25% customs duty on steel imports from China and a 10% additional one on aluminum imports from China.

This, however, increases the production costs of the aforementioned US sectors that still handle and stand up to global competition, which obviously recoup the money lost from end customers, by increasing prices.

If – like the USA, but perhaps not for much longer – a country still lives on electronic manufacturing and components, the increase in the factory unit prices leads to an increase in the final price and, hence, restricts domestic or foreign markets.

Any price increase, albeit small, leads to a decrease in the buyers of those goods. Pareto taught this to us ad nauseam.

But clearly, it was not enough.

Later, on April 3, President Trump announced he would impose further 25% duties on additional 50 billion Chinese imports of electronics and aerospace products, as well as machine tools.

This means that – paradoxically, but not too much so – President Trump wants to slow down precisely the productive sectors that China deems strategic for the future, as shown in its Plan for 2025.

In 2017, China produced a total of 23.12 trillion US dollars, calculated on the basis of power purchasing parity (PPP).

Currently, the EU ranks second, with 19.9 trillion US dollars, again calculated as PPP. In 2016, it was the world's top producer.

The United States only ranks third, with a yearly product of only 19.3 trillion dollars.

Financial stones cannot be turned into loaves of bread.

In spite of everything, China has a yearly per capita income of USD 16,600, while the US yearly GDP per capita is equal to 59,500 US dollars.

Scarce domestic consumption, all focused on exports, is the Chinese model that has developed since Deng Xiaoping’s “Four Modernizations,” which survives only in an area in which all macroeconomic variables are not left to some “market” invisible hands, but to a central authority.

However, this is exactly the reason why China is the largest world exporter.

Hence it rules end markets.

In 2017, it shipped abroad USD2.2 trillion worth of goods and services.

Currently, 18% of Chinese products are exported to the United States.

This much contributes to the US trade deficit, which currently amounts to USD375 billion.

China is also the second largest importer in the world, to the tune of USD1.7 trillion in 2017.

The mechanisms of interaction between China and the United States, however, are even more complex than we could guess from these scarce data and statistics.

It is not by mere coincidence that China is still the largest holder of US public debt.

In January 2018, China held 1.2 trillion in US government debt securities, i.e., 19% of the US public debt held by foreign investors.

A very powerful monetary, political, strategic, and even military leverage.

Obviously, China buys US securities to back the value of the dollar, to which the yuan is pegged.

However, it devalues its currency (and hence the US dollar) when Chinese prices need to be kept competitive.

Therefore, while the United States wants to increase the yuan value, with a view to favoring its exports, China threatens to sell its US public debt securities immediately.

The dollar increased by 25% between 2014 and 2016, but since 2005 China has devalued the yuan.

A very clear example of aggressive monetary pegging.

Moreover, the issue of China's unfair commercial behavior is now long-standing and it was also raised by many candidates to the US presidential elections.

In fact, the success of Paulson, the former US Treasury Secretary, was to reduce the American trade deficit with China and to later ask for opening to foreign investment in key sectors of the Chinese economy.

For example, in the banking sector, thus putting an end – in some cases – to the Chinese practice of export subsidies and administered and capped prices.

Just deal with realism and intelligence, and Chinese Confucianism can find solutions to everything.

The other side of the Chinese miracle, however, is the very high debt of companies and households, which is obviously still connected to the balance between the yuan and the US dollar.

In this case, however, the programmed slowdown of the Chinese GDP growth and the limits on strong currency exports, as well as the control of wages and profits are enough.

But let us revert to President Trump's tariffs and duties.

The US President has imposed these new tariffs and duties on Chinese imports to force China to remove the foreign investors’ obligation to transfer technology and patents to their Chinese partners.

Nevertheless, China trades many products it could also manufacture on its own just because it wants to fully open Western intellectual property rights for its companies.

A few hours later, however, China responded to President Trump with a 25% increase in duties on 50 billion dollars of US exports to China.

On April 6, President Trump further reacted by stating he would call for the imposition of other duties on additional 100 billion dollars of imports from China.

It is worth noting, however, that this accounts for only a third of total US imports from China, which is considering the possibility of responding harshly to President Trump by steadily increasing tariffs and duties for all US products entering Chinese markets.

Besides the issue of relations with China, the other side of the US tariff and duty issue is the NAFTA renegotiation, officially requested by President Trump on August 16, 2017.

It should be recalled that the North American Free Trade Agreement is the largest commercial agreement currently operating in the world, signed by Canada, Mexico, and the United States.

Firstly, President Trump wants Mexico to cut – almost entirely – VAT on imports from the USA and put an end to the program of maquiladoras, i.e., the factories owned by foreign investors in Mexico, in which the components temporarily imported into that country under a duty-free scheme are assembled or processed.

The maquiladoras program started in 1965 to reduce the huge unemployment in the North Mexican regions, but currently, there are at least 2,900 such factories between Mexico and the USA producing 55% of total Mexican export goods.

They mainly manufacture cars and consumer electronics, which are exactly the sectors that – as already seen – President Trump wants to revitalize.

Obviously, the current US Presidency wants to dismantle the maquiladoras on its Mexican border, where 90% of such companies are located.

Thanks to these special factories, Mexico competes directly with US workers, considering that the local Central American workforce is much cheaper.

Thanks to this mechanism of cross-border production outsourcing – between 1994 and 2010 alone – 682,900 US jobs moved to Mexico, with 80% of US jobs lost in the manufacturing sector.

Moreover, again due to NAFTA, as many as 1.3 million jobs in Mexican agriculture were lost.

In fact, following the removal of duties between the USA and Mexico, the latter was flooded with US produce below cost and subsidized by the State.

All this happened while the Central American administration cut agricultural subsidies – which will soon happen in the crazy EU as well – and focused the little State aid left for agriculture to the big haciendas, thus destroying and ruining small farmers.

Liberal and free-trade masochism.

NAFTA, however, also has many advantages for the United States.

Without the tripartite inter-American agreement, North American food prices would be significantly higher, while also oil and gas from Mexico and Canada would be much more expensive for US consumers.

As Carl Schmitt taught us, the American Monroe Doctrine (epitomized by the slogan “America to the Americans”) was developed above all against Europe. Nevertheless, the agreements like NAFTA allow sharing – at least partially – the benefits of increased trade between the USA, Canada, and Mexico in a less asymmetric way than usual.

The US primacy theorized by Monroe in 1823 and later rearticulated by Roosevelt in his State of the Union address in 1904, with the Roosevelt Corollary whereby “chronic wrongdoing may in America, as elsewhere, ultimately require intervention by some civilized nation and force the United States, although reluctantly, in flagrant cases of such wrongdoing, to the exercise of an international police power,” holds true also at the economic level.

But are we currently sure that the most civilized nation is still the Northern one?

Just to better understand what we are talking about, it should be noted that the NAFTA agreement is made up of 2,000 pages, with eight sections and 22 chapters.

As such, it is currently worth 0.5% of the US GDP.

Since the official implementation of this agreement in the three countries which have adopted it, North American exports have created as many as 5 million jobs, with the creation of 800,000 additional jobs in the USA alone.

Nevertheless, approximately 750,000 other jobs have also been lost in the United States alone, mainly due to the transfer of US activities to Mexican maquiladoras.

A slight surplus.

Moreover, NAFTA has anyway ensured the status of "most favored nation" to Canada and Mexico and has removed all tariffs and duties for the goods produced in one of the three Member States. It has finally established certain and clear procedures for settling trade disputes between the companies of every country belonging to it.

But above all, NAFTA enables the United States to better compete with EU and Chinese products, by reducing the prices of the NAFTA goods wherever they are produced.

Also in this case, however, President Trump has threatened to walk out of the inter-American trade treaty and impose a 35% duty on imported Mexican products.

The aim is obviously to bring back investment in the maquiladoras to the United States.

Is this useful, also with regard to an evident trade war with the EU, Japan, and China, as usual?

Is there currently sufficient real liquidity in the United States to back the supply increase which is thus created, with the return of all these productions back home?

Or is the idea prevailing of having everything be bought on credit, with all the consequences we can easily imagine?

Or is it possibly a matter of sending the NAFTA productive surplus back to European, Chinese and Asian markets?

Moreover, with specific reference to another multilateral trade agreement, the Trans-Pacific Partnership (TPP), President Trump announced he would like to establish a series of new bilateral trade relations that the US President likes more than the multilateral ones.

It is worth recalling that the TPP applies to the USA and to other 11 countries around the Pacific Ocean, namely Australia, Brunei, Canada, Chile, Malaysia, Japan, Mexico, New Zealand, Peru, Singapore and finally Vietnam.

All these countries together account for 40% of the total global GDP, which is currently equal to USD107.45 trillion annually. They are also worth over 26% of world trade per year and as many as 793 million global consumers.

Obviously, the list does not include China and India, considering that the TPP architecture has been designed to surround, close or at least limit the growth of the two great Asian countries.

President Trump also wants to renegotiate the TPP, which by 2025 is expected to increase trade among all Members States to the tune of 305 billion us dollars per year.

Hence, if President Trump walks out of the TPP, many Member States will look to China for replacing the USA – and, indeed, many of them are already doing so.

Therefore, the US President’s idea is to make the United States grow – through this wave of various forms of protectionism – by at least 6% a year, with an expected 3% net tax increase.

Too much. It would inevitably lead to high inflation and the classic boom-bust cycle.

If the economy grows by 2-3% a year, the cycle can expand almost indefinitely.

Conversely, if there is too much money looking for too few goods to buy, inflation will always come, and the booming phase will stop all of a sudden.

Hence, the bust materializes, with the quick reduction of wages and credits, as well as with an increase in prices and interest rates.

Therefore, President Trump’s very dangerous idea is that – in such a monetary and economic context – the United States can keep on borrowing all the liquidity needed because, as he said recently, “we never default, because we can print our currency.”

This is true. But if too many green bucks are printed, interest rates will rise immediately, and this new version of Reagan-style supply-side economics will be stopped.

Finally, a very serious recession would materialize, which currently would not be so easy to export to “friendly” countries.

Recently, the dollar area has much shrunk.

It is no longer true – as the former US Treasury Secretary John Connally once told to his European colleagues – that “the dollar is our currency, but it is your problem.”

So far, however, President Trump has decided 29 commercial or financial deregulation operations and over 100 internal guidelines and directives to the Administration, as well as other 50 new global market rules discussed by the Congress.

On February 3, 2017, the US President also decided to reform and almost repeal the rationale of the Dodd-Frank Wall Street Reform Act, with rules and regulations further reducing checks and audits on banks, which are no longer obliged to send to the Treasury Ministry data and information about the loans granted.

Moreover, the banks with clients’ deposits lower than USD10 billion must not even abide by the Volcker Rule, which forbids banks to use clients deposits to make a profit.

Therefore, since 2015, banks cannot hold hedge funds and private equity funds.

Nowadays, however, with the reform of the Dodd-Frank Act, many credit institutions can avoid these difficulties and restrictions and play roulette with clients’ deposits.

For the new US lawmaker, Volcker’s and Greenspan’s policy was a way to avoid the implosion of the US financial system, after the fatal end of the Glass-Steagall Act which had been lasting since 1933.

It is worth recalling that the Glass-Steagall Act had come into force when the Roosevelt’s Presidency decided to imitate the Fascist legislation of the new separation between deposit banks and merchant or investment banks.

Banks did not want the Glass-Steagall Act because they wanted to be “internationally competitive.”

They also wanted to create money at will, regardless of the relationship between investment and collection.

What happened is before us to be seen.

President Trump wants to abolish even the Departments of Education and Environmental Protection, with an increase in military spending that is supposed to lead to a total public deficit of USD577 billion.

Hence, in this new context, can the US Presidency avoid the Chinese commercial pressure and also ensure that the jobs repatriated to the USA from NAFTA, from negotiations with Japan, from the TPP and the rest of the multipolar trade system are such as to back the dollar without creating excessive inflation?

Moreover, all international trade experts agree that it is not the simple and traditional tariff barriers – but rather the non-tariff ones, which are very fashionable today – to cause real problems.

In short, we need to consider trade policy together with strategy: if US protectionism increases, the growth of peripheral economies will decrease.

Thus, there will be increasing possibilities of crises in developing countries, while China's desire to replace the USA in multilateral economic mechanisms that directly affect it may increase enormously.

Also the desire of global US competitors, such as the EU, to replace US exports at unchanged rates – at least for a short lapse of time – may increase.

There is no need for dumping – non-tariff transactions and the quality standard of made-in-Europe products are enough.

Therefore, nowadays, nothing is certain.

Certainly not US protectionism, of which we have noted the dangers for North America and also for its geo-economic partners. Not even universal free trade, which does not consider the political evaluations and the economic, monetary and military planning of the various world commercial areas, is feasible and practicable.

Indeed, as in military policy, a great agreement – as the initial GATT was – is required in the current world market, with a view to establishing – for at least ten years – the areas and spheres of economic and productive influence and their possible future changes.

There is no free trade without planning.